|

|

|

|

Author

|

Topic: Disney to Give Up $150 Million in Revenue This Year Ahead of Streaming Service Launch

|

Harold Hallikainen

Jedi Master Film Handler

Posts: 906

From: Denver, CO, USA

Registered: Aug 2009

|

posted 02-09-2019 12:47 PM

posted 02-09-2019 12:47 PM

https://www.thewrap.com/disney-to-give-up-150-million-in-revenue-this-year-ahead-of-streaming-service-launch/

Disney to Give Up $150 Million in Revenue This Year Ahead of Streaming Service Launch

“Captain Marvel” will be the first film not included in Disney’s output deal with Netflix

Ahead of the launch Disney+ later this year, Disney is prepared to miss out on $150 million in licensing fees as it holds back content for its much-anticipated streaming service.

There was no launch date announced, but during the company’s quarterly earnings conference call, Disney CEO Bob Iger and CFO Christine McCarthy gave investment analysts some insight on how the launch of the Disney+ streaming service will continue to impact the company’s finances moving forward.

McCarthy said Disney was expecting a loss of $150 million from it overall revenue for the full year, due to the lack of licensing output deals associated with the new streaming service. The company has said for a while now that its output deal with Netflix would end after 2018. McCarthy noted that the upcoming “Captain Marvel” will be the first new Disney film that won’t go through the traditional post-theatrical sales market. Instead, Disney will hold the film as an exclusive offering for Disney+.

Investors can expect to see the bulk of that $150 million for this year fall in the second half of the 2019 fiscal year, which ends Sept. 30. It’s not known how much revenue the streaming service might make up.

Disney’s streaming service could be a watershed moment for the company and the industry. Disney has relied on the licensing revenue from the likes of Netflix for its top-shelf content for so long and is now — some analysts might say finally — going out on its own.

Operating its own streaming service could open other avenues for Disney — Iger said during the call that down the road Disney could even look to adjust the release windows for films.

“We’re not looking to compress the theatrical window here, though, there may be opportunities to adjust the window for when we bring things onto the [Disney+] app,” Iger said.

In addition to the $150 million Disney will forgo by launching its own streaming service, the Mouse House has incurred heavy losses thanks investments in streaming. In an SEC filing in January Disney reported losing more than $1 billion in 2018 combined between Hulu and BAMTech, the technology that powers its ESPN+ streaming service and will power the Disney+ platform. Hulu drove a $580 million equity investment loss during Disney’s fiscal year, which ended on Sept. 30, while BAMTech was the primary reason for a $469 million loss in its direct-to-consumer segment.

“The investments we’re making on the technology side and increasing our incremental content are all designed for the long term. This is the equivalent of deploying capital to build out theme parks,” Iger said. “This is a bet on the future our business. We are deploying our capital so that the long-term growth of this company is stronger than it would have been without these investments.”

During the company’s 2019 first quarter, Disney reported adjusted earnings per share of $1.84 and revenue of $15.30 billion, both of which surpassed Wall Street analysts’s expectations for the quarter.

| IP: Logged

|

|

|

|

Mike Blakesley

Film God

Posts: 12767

From: Forsyth, Montana

Registered: Jun 99

|

posted 02-11-2019 12:22 PM

posted 02-11-2019 12:22 PM

This is a related, interesting read. I included a couple of the more interesting graphics but the article is really better if you click the link and see all the graphics.

Summarized, it basically says that Netflix can't continue to spend the way they do on content and not slowly go broke. They either need to get more subscribers or raise their price, and both are difficult to do in the face of increasing high-stakes competition. (Losing all the Disney content over the next 18 months isn't going to help.)

REALITY CLOSING IN ON NETFLIX

Shifting sentiment, as seen through price action in equity and debt markets, signals that investors are losing patience with Netflix’s extraordinary cash flow burn ($13 billion since 2011).

For example, the 4% drop in the stock after the most recent earnings report shows that subscriber growth is no longer enough. Netflix needs to prove it can monetize its original content before competition (with decades of monetization success) takes more market share. Time is running out for Netflix’s current business model to work.

Increasingly skeptical investor sentiment leads me to put Netflix (NFLX) back in the Danger Zone.

As I stated on CNBC’s Closing Bell on January 16, 2019, Netflix needs over 500 million subscribers at $20/month to justify $350/share. Without additional price increases, NFLX needs half the global population to sign up for Netflix. See Appendix I (below) for the straight forward math behind this analysis and my reverse DCF model.

I think these expectations are unrealistic, and the evidence backing up this belief continues to grow, as you’ll see below.

NFLX’s trading pattern shifted last year as it no longer moved in tandem with the “good” news. Per Figure 1, NFLX ended 2018 down 36% from its early July highs. After bouncing back to start 2019, NFLX is down 8% since January 15 (S&P +1%).

Investors are signaling that they will not subsidize Netflix’s huge cash losses forever. They need the company to show it can monetize its content in the face of mounting competition.

Figure 1: NFLX Was Down 36% in Last Five Months of 2018

Debt investors are not happy either. In fact, they’ve always been more skeptical and assigned Netflix’s debt “Junk” ratings since as early as 2015. In the last year, that skepticism has grown, as the yield on its issuances has increased 150 basis points. Since 2017, the cost of debt has risen 275 basis point to 6.375%. Should debt investors grow more weary of Netflix’s massive cash burn, the liquidity they’ve provided could dry up quickly. See Appendix II (below) for more details.

Subscriber Growth Not Enough to Justify Content Spending

The main reason investors are losing confidence is that Netflix’s subscriber growth has not generated enough revenue growth to cover the increase in content spending. Since 2011, revenue has increased by $12.6 billion, which is half the total increase in expenditures over the same time, per Figure 2. The difference in revenue and expenditures means Netflix has burned through nearly $13 billion since 2011. For the Netflix business model to work, subscriber revenue growth has to cover the cost of increased expenditures. To date, the model is not working – not even close.

The leverage investors need to see in Netflix’s business model has not been present in the past and has still not emerged. Increasingly, investors are less willing to believe that leverage will ever emerge, per Figure 1 above.

Figure 2: Netflix’s Revenue Growth Lags Spending Growth by 50%

Increasing Competition Will Slow Subscriber Growth

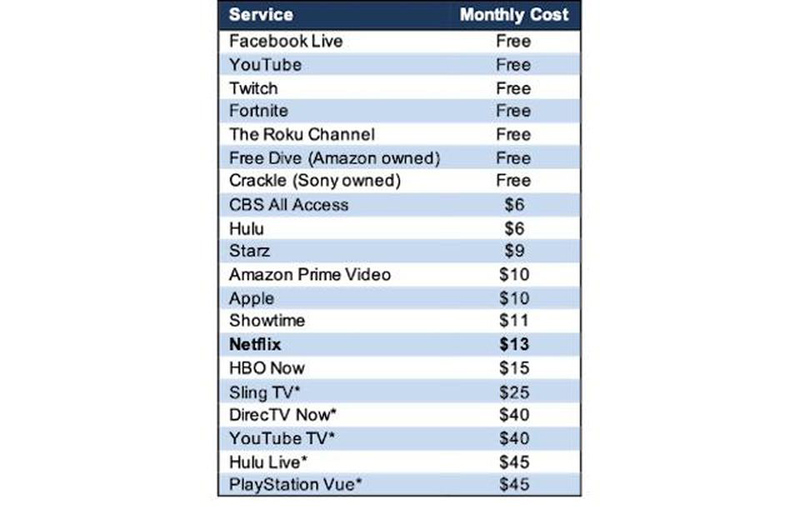

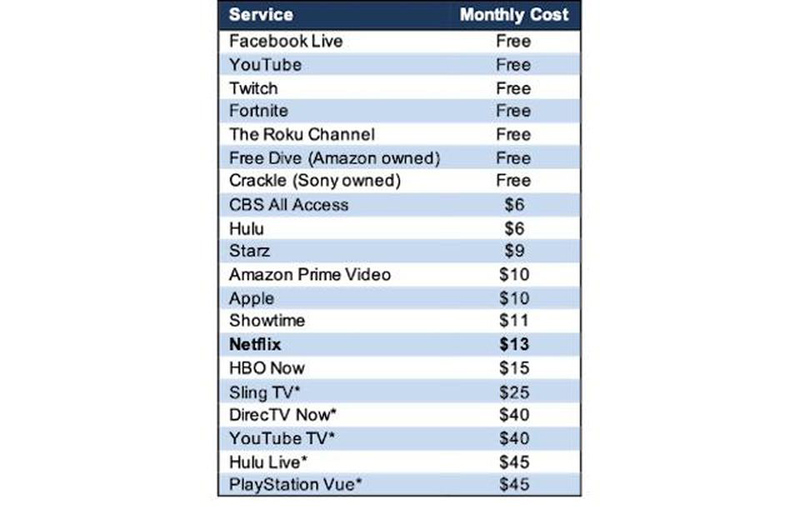

While Netflix was among the first to offer video streaming, it is no longer the only option. Competition includes:

Figure 3: Netflix Faces More Competition Now Than Ever Before

* Includes live TV channels commonly available through cable or satellite

Apple (AAPL), Disney (DIS), Warner Media (T), and NBC Universal (CMCSA) are all expected to release their own streaming platforms by 2020. These new entrants, with vast resources, could pose a significant threat to Netflix when it comes to licensing existing content.

Losing “Successful” Content Will Slow Subscriber Growth

A big part of Netflix’s success in growing subscribers has been the content that its competitors provide.

Disney has already stated that it plans to end its licensing agreement with Netflix and pull its content by the end of 2019. Furthermore, Warner Media could pull the popular Friends series, which Netflix just paid $100 million to keep on its platform for another year. Additionally, NBC Universal could also pull The Office, which, according to recode “NBCU execs say Netflix has told them “The Office” generates more viewing hours than anything else on the service.” Such a loss (or losses) would truly test the stickiness of Netflix’s original content.

Price Increases Will Slow Subscriber Growth

Every price increase makes Netflix’s competitors more powerful. The more Netflix charges subscribers, the more its competitors can charge.

Raising prices makes it easier for firms to compete for subscribers with Netflix. Raising prices makes it harder for Netflix to grow subscribers. But, Netflix has to raise prices to attempt to stem its unsustainably high cash burn.

What is Netflix to do? What is defensible about the Netflix business model?

Meanwhile, competitors smell blood in the water. After a year when Hulu grew subscribers at a faster rate than Netflix, it decided to lower the price of its most popular plan by 25%, to just $5.99/month.

Pricing Power Is an Illusion

Pricing power means a firm can make money while charging lower prices than its competition. The narrative that Netflix holds significant pricing power is false. Netflix must raise prices to make money and stop the huge cash losses, which investors cannot afford to subsidize for much longer.

Inability to Monetize Content While Competition Can

I put successful in quotes above because the mentioned shows have proven they can be monetized over many years. Not surprisingly, they’re produced by some of the top studios in the business, such as Disney.

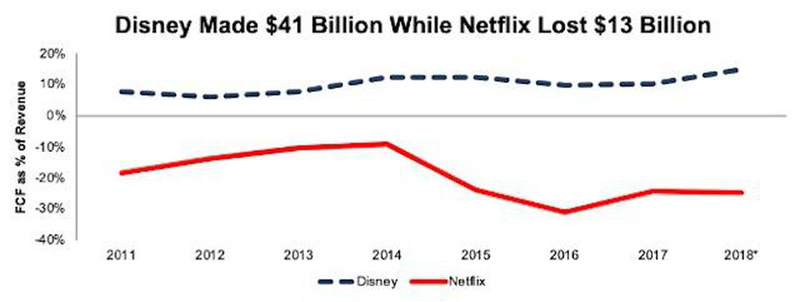

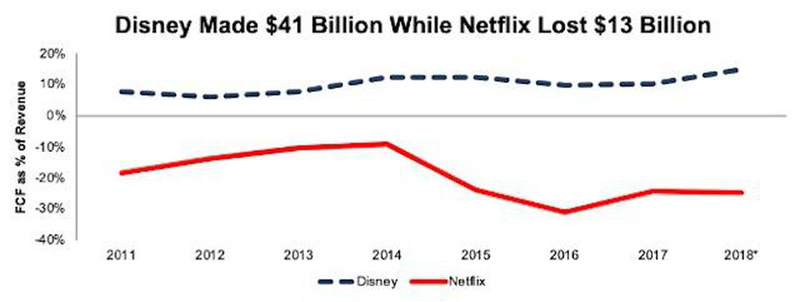

It’s no secret that Disney is one of the best when it comes to monetizing. Its content can earn revenues through box office, merchandise, licensing deals, theme parks, and soon enough, streaming. With its Disney+ service, the firm will throw its full weight (and massive resources) into the streaming ring. Compared to Netflix, the trajectories of the two firms couldn’t be more reversed.

At Disney, you have a firm that has generated $41 billion in cumulative FCF since 2011. Its FCF as a percent of revenue has been double digits or higher in each of the past five years, and positive every year since 2011. Meanwhile, Netflix has burned through $13 billion in cumulative FCF since 2011 while FCF as a percent of revenue has been negative each and every year, per Figure 4.

Figure 4: Content Monetization: Disney Makes $ vs. Netflix Loses $

* 2018 FCF estimated based on financial data in NFLX’s earnings press release. Final number will be calculated once 10-K is published.

Where Do All These Pressures Leave Netflix – the AOL of OTT?

If Netflix doesn’t have pricing power, faces significant competition, doesn’t stack up well (financially) with the largest competition, and is losing the trust of debt and equity investors, what does it have? The ability to raise money.

But, if nothing about the business is defensible, besides raising money, which won’t last forever, does that make Netflix the AOL of over-the-top (OTT)? Jonathan Klein, former president of CNN, co-founder of Tapp Media, and current president of Vilynx stated such a comparison recently on Bloomberg TV.

Netflix was the first to stream video content to a mass amount of users. However, just as with AOL, nothing stops competitors from doing the same at equal or cheaper prices. Now, as Netflix raises prices, consumers can look elsewhere to find greater value. Furthermore, if your only advantage is the ability to spend cash, how do you compete with those that have significantly more cash, such as Apple, Disney, Alphabet (GOOGL), or Amazon (AMZN)? This juxtaposition could explain the rise in analysts voicing skepticism about Netflix while praising the future growth potential for Disney.

Can Netflix consistently provide better content than the rest of the industry for long enough to justify its current valuation? The evidence leads me to believe the answer to this important question is no.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Appendix I

Figure I: Subscriber Expectations Baked into NFLX

NFLX Implied Subscriber ExpectationsNEW CONSTRUCTS, LLC

Scenario 1: Steady Growth – in this scenario, I assume Netflix can continue growing revenues at 26% a year (CAGR since 2011) and maintain current pre-tax margins of 11%. Such expectations are nothing to balk at, as even the most well run companies would be glad to grow revenues at such a pace for a prolonged period of time. Netflix would have to maintain this growth rate and margin for the next 17 years simply to justify its current stock price of $322/share. In this scenario, Netflix would be generating over $594 billion in revenue 17 years from now. Netflix would need over 3.8 billion subscribers at the current average price of Netflix’s subscriptions, which equals $13/month. See the math behind this dynamic DCF scenario.

While I find it hard to believe nearly half the global population will sign up for Netflix, many believe Netflix can continue to raise prices and improve profitability, rather than go after 3 billion subscribers. I can also model such an optimistic scenario, as seen below.

Scenario 2: Profitability in Line with Disney – in this scenario, I assume Netflix can grow revenues at 30% a year and more than double its pre-tax margin to 25%, which equals Disney’s 2018 pre-tax margin. Netflix would have to maintain this growth rate and margin for the next nine years to justify its current stock price. In this scenario, Netflix would be generating over $123 billion in revenue nine years from now. If I assume Netflix can increase its average price to $20/month, it would need 516 million subscribers to reach the revenue implied by this DCF scenario. See the math behind this dynamic DCF scenario.

Importantly, both scenarios assume Netflix’s invested capital grows 20% compounded annually, which would be significantly slower than in the past. Since 2015, invested capital (based on estimated 2018 value), driven mostly by additions to the streaming content library, has grown 50% compounded annually.

Ultimately, to believe in Netflix at this price, you have to believe that the company can drastically increase its prices (or sign up half the world), reduce the growth in its content spending, and continue to grow its subscriber base at double-digit rates for nearly a decade or longer.

Appendix II

Since 2014, Netflix has raised more than $9.8 billion (7% of market cap) in capital, which includes:

$0.4 billion in February 2014

$1.5 billion in February 2015

$1.0 billion in October 2016

$1.4 billion in April 2017

$1.6 billion in October 2017

$1.9 billion in April 2018

$2.0 billion in October 2018

Forbes article

| IP: Logged

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marcel Birgelen

Film God

Posts: 3357

From: Maastricht, Limburg, Netherlands

Registered: Feb 2012

|

posted 02-13-2019 06:41 PM

posted 02-13-2019 06:41 PM

quote: Harold Hallikainen

This is similar to the video store method. You did not need to pay a subscription fee to the video store. You paid for each video you rented. Why not do the same for streaming?

I can't predict the future, but right now, reality isn't in tune with this.

In the industry, the most common terms are SVOD and TVOD. SVOD: Subscription Video On Demand a.k.a. the Netflix model. SVOD: Transactional Video On Demand a.k.a. the old-school pay-per-view model.

TVOD has been around for ages, but is currently dying a slow death. It seems that people prefer paying for subscriptions than to pay on a transactional basis.

You see the "all-you-can-eat" model everywhere in the industry. Flat-fee broadband, all-you-can-hear music streaming, all-you-can-eat sushi restaurants, all-inclusive hotels, cruises and also theme parks not charging per attraction, but just a single, all-you-can-ride entrance fee per day. And I'm sure we could easily make this list three pages longer.

I guess many people simply don't want to think about "money" when they're watching TV. They simply want to relax. There is even still some merit in linear programming, since some people simply just want to be spoon-fed, instead of making up their mind of what they want to watch.

So, is there NO future for "TVOD"? Well, I think there might be, but only for the best content, nobody is going to pay per episode for some mediocre Netflix series, but there will be quite a market for the next Game of Thrones episode, especially if you, for example, could watch it one day before "everybody else"...

| IP: Logged

|

|

|

|

|

|

All times are Central (GMT -6:00)

|

|

Powered by Infopop Corporation

UBB.classicTM

6.3.1.2

The Film-Tech Forums are designed for various members related to the cinema industry to express their opinions, viewpoints and testimonials on various products, services and events based upon speculation, personal knowledge and factual information through use, therefore all views represented here allow no liability upon the publishers of this web site and the owners of said views assume no liability for any ill will resulting from these postings. The posts made here are for educational as well as entertainment purposes and as such anyone viewing this portion of the website must accept these views as statements of the author of that opinion

and agrees to release the authors from any and all liability.

|

Home

Home

Products

Products

Store

Store

Forum

Forum

Warehouse

Warehouse

Contact Us

Contact Us

Printer-friendly view of this topic

Printer-friendly view of this topic

![[Big Grin]](biggrin.gif)